When Does the Federal Budget Run Out Again

Upcoming Congressional Fiscal Policy Deadlines

Updated 3/15/22: The President signed the FY 2022 omnibus appropriations nib, which the Senate passed the night of Th, March 10, by avote of 68-31, immigration it for enactment. The House had passed the measure on Midweek, March nine, by votes of 361-69 (security portion) and 260-171-ane (non-security portion). Congress needed to complete appropriations work and the President needed to sign the measure by Tuesday, March fifteen, when the final FY 2022 standing resolution expired.

A iv-twenty-four hour period CR through March 15 had been enacted during consideration of the jitney to allow actress fourth dimension for Senate passage and signing past the President. Previously, Congress enacted a 3rd FY 2022 CR, extending through March 11, 2022, in February. Congress needed to pass another continuing resolution by the cease of the night of Friday, Feb. xviii, when the CR enacted in early Dec was scheduled to elapse.

The White Firm appear an additional iii-month delay in pupil loan repayments on Wednesday, Dec. 22. The intermission on repayments would accept otherwise ended at the end of January.

President Biden signed legislation to increase the debt limit by $2.five trillion on Thursday, December. 16, following weeks of uncertainty and separate enactment of procedural legislation related to expediting activeness on the debt limit. Both chambers needed to pass legislation increasing the debt limit earlier exhaustion of Treasury funds, before the cease of December.

Before in the fall, President Biden signed the Infrastructure Investment and Jobs Act, that reauthorized highway and transit programs through FY 2026, averting a shutdown of transportation programs, ending a serial of extensions since the finish of FY 2020, and preventing insolvency to the Highway Trust Fund through boosted transfers of coin.

In March 2021, President Biden signed the American Rescue Plan, enacted through budget reconciliation, which included an extension of expanded unemployment benefits, stimulus checks, enhanced tax credits for families, and a range of other programs designed to reply to the economic and public health consequences of the COVID-19 pandemic. In late December 2020, lawmakers enacted a combined omnibus appropriations bill and COVID-19 relief package that funded the government, included tax and health extenders, extended programs such as TANF, and provided more $900 billion in back up for individuals, businesses, and institutions affected by the pandemic . The appropriations, debt limit, infrastructure, and reconciliation packages ready many of the deadlines described below.

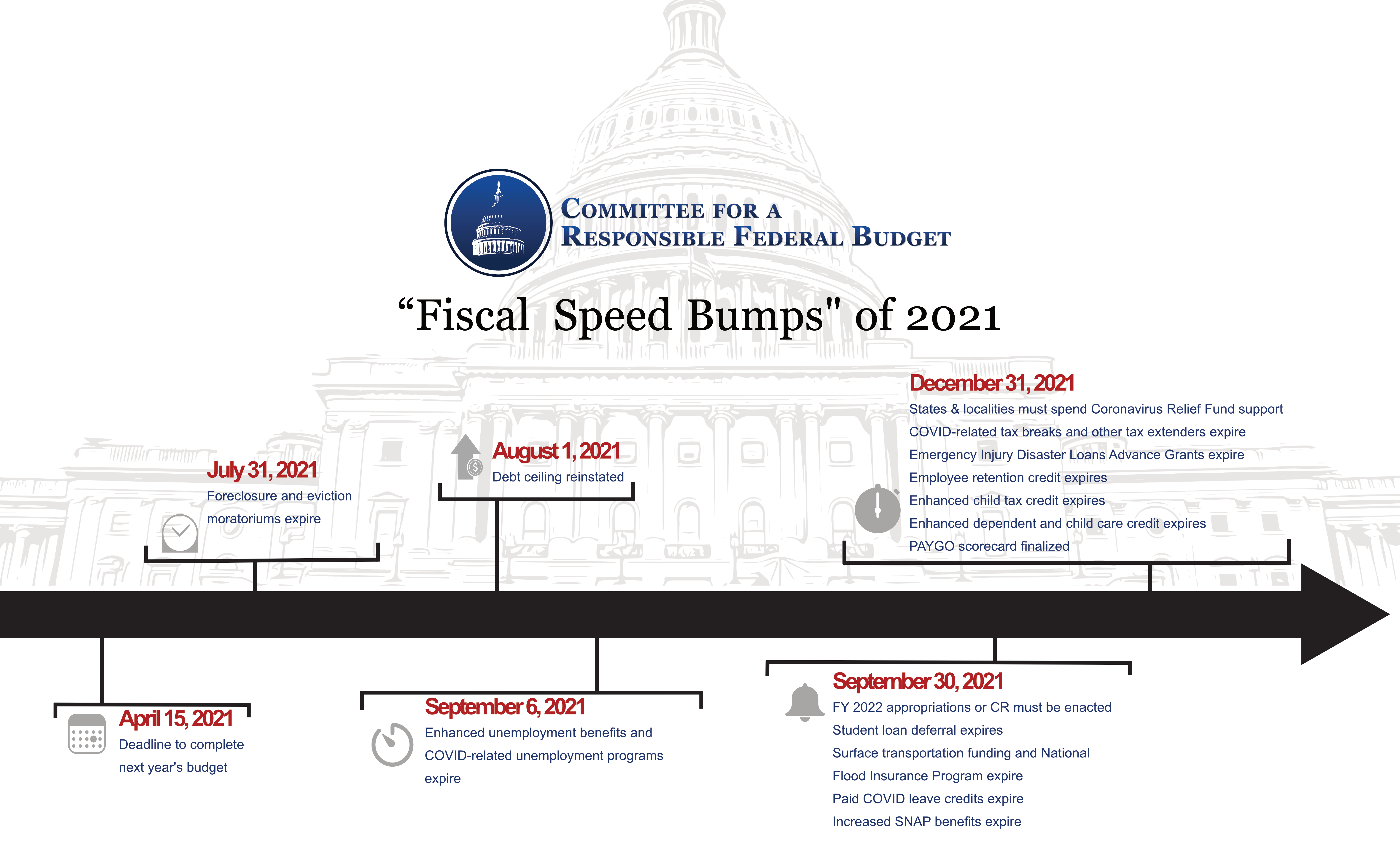

The side by side few years volition include several predictable fiscal policy deadlines that volition forcefulness congressional action. Many provisions providing COVID relief are expiring either in September or at the end of the year. Many of the regular non-COVID deadlines could bring additional costs if Congress acts irresponsibly, or they could present an opportunity for Congress to reduce deficits.

We volition regularly update this tracker to help reporters, congressional staff, and others interested in fiscal policy go on tabs of major deadlines. We recommend that yous bookmark it and come up back to cheque in.

Congress may be compelled to deed on each of these dates or enact short-term extensions to move the deadlines to buy fourth dimension for action.

| Issue | Borderline | More Data |

|---|---|---|

| Delay of 2% Medicare Sequester | March 31, 2022/June 30, 2022 | The Dec 2020 COVID relief and omnibus parcel delayed the two percent Medicare sequester cuts that were supposed to resume Jan 1, 2021, for 3 additional months. Legislation to again filibuster the sequester was enacted in the jump, ultimately extending the policy through the end of the year. On Dec seven, the House passed a nib to delay the Medicare sequester until the second one-half of FY 2022, by a 222-212 vote. The Senate passed the legislation on Dec. 9 by a 59-35 vote, and the President signed it on Dec. 10. Under the contempo legislation, the Medicare sequester would be completely delayed until the terminate of March 2022, then reduced to ane per centum (from 2 percentage) through June 30, 2022. |

| Student Loan Executive Order | May one, 2022 | Later the CARES Deed suspended payments for federal student loans, an August 2020 executive society provided for continued student loan deferral and 0% involvement rate, which was subsequently extended to January 31, 2021. President Biden asked the Section of Didactics to farther extend information technology through September 2021 and so for an additional extension through January 2022, for a full extension of nearly 22 months. In late December, Biden appear a farther three-month extension until May. |

| Funding the Regime / Appropriations | September 30, 2022 | After iv standing resolutions, Congress enacted an FY 2022 omnibus appropriations neb that was signed into constabulary on March xv. It covers the residual of the fiscal year. Q&A: Everything You Should Know Near Government Shutdowns; Appropriations Scout |

| National Inundation Insurance Program Authorization Expires | September thirty, 2022 | A brusk-term flood insurance extension was included in the FY 2022 omnibus appropriations bill. More on NFIP |

| Authority of TANF & Related Programs Expires | September 30, 2022 | Temporary Assist for Needy Families and the Child Care Entitlement to States were extended for roughly two months in the FY 2022 bus appropriations pecker. |

| Nutrient & Drug Administration User Fee Programs | September 30, 2022 | User fee programs are paid by the pharmaceutical manufacture to finance the Food and Drug Administration'due south (FDA) review of prescription drugs and other medical products. These programs were last reauthorized in 2017. |

| Medicare Radiation Oncology Rules | December 31, 2022 | A delay to the implementation of the radiation oncology model under the Medicare program would expire. The December COVID relief and coach package provided for a statutory six-month additional delay, in addition to the delay announced by CMS. The alter is intended to requite providers more fourth dimension to adapt to the new payment system. On December 7, the House passed a bill to delay the radiation oncology rules until 2023, by a 222-212 vote. The Senate passed the legislation on December. ix by a 59-35 vote. |

| Medicare Physician Bonus Payments | December 31, 2022 | The Dec 2020 COVID relief and omnibus package provided a temporary 3.75 percent Medicare dr. bonus to assistance medical practices with COVID-related shutdowns. On December 7, the House passed a pecker to extend the Medicare doctor bonus payment at 3 percent in 2022, by a 222-212 vote. The Senate passed the legislation on Dec. 9 by a 59-35 vote, and the President signed information technology on Dec. x. |

| Other Tax Phase-Outs & Expirations | December 31, 2022 | The full expensing tax preference included in TCJA begins to phaseout in 2023 and ends completely by the beginning of 2027. Other policies expire completely, including the business meals deduction. |

| Statutory PAYGO | December 2022 or January 2023 | Statutory pay-every bit-you-get (PAYGO) rules provide for an across-the-lath sequester of non-exempt mandatory spending programs if lawmakers enact internet deficit-increasing legislation over the course of the year. Whenever lawmakers enact legislation affecting mandatory spending or revenues, the Function of Direction and Budget (OMB) records the budgetary effect of the constabulary, divides the ten-yr outcome, and puts that amount on the PAYGO scorecard for each of the x years. If Congress adjourns for the yr with deficit increases yet on the PAYGO scorecard, OMB bug an offsetting sequester. Lawmakers could address statutory PAYGO effects stemming from the American Rescue Plan or subsequent legislation through a separate vote subject to a sixty-vote threshold in the Senate or face a sequester large enough to eliminate sure mandatory programs. Legislation that passed the Firm on March 19 included an exemption of the American Rescue Program from the PAYGO scorecard. On December seven, the Firm passed a bill to deduct any sequestration full from the 2022 scorecard and add it to the 2023 scorecard, by a 222-212 vote. The Senate passed the legislation on Dec. nine by a 59-35 vote, and the President signed it on Dec. 10. Considering statutory PAYGO requires OMB to upshot a sequestration order within 15 days of the end of a congressional session, the cuts could now have outcome in either Dec 2022 or January 2023. |

| Debt limit | Early on 2023 | The debt ceiling will probable need to be raised or suspended afterwards a $two.v trillion debt limit increment enacted in December 2021 is exhausted. |

Longer-Term Deadlines

- End of 2023: Moratorium on payment nether the Medicare physician fee schedule for complex services described by Healthcare Common Procedure Coding Arrangement (HCPCS) code G2211 expires; various Medicare extenders elapse; tax provisions such as the energy investment tax credit for solar and residential energy-efficient property expire.

- Cease of 2024: Current Medicare md Alternative Payment Model (APM) thresholds elapse (based on operation year 2022).

- Stop of 2025: TCJA individual income taxation provisions expire; TCJA paid family exit credit expires; employer-paid student loans income exclusion expires; multiple revenue enhancement extenders expire such as Empowerment Zones incentives, film and alive performances expensing, and the wind free energy investment tax credit; health extenders including the Rural Customs Hospital Demonstration plan.

- FY 2026: Medicare Hospital Insurance (Role A) Trust Fund exhaustion

- End of FY 2026: Surface transportation programs authorisation provided by Infrastructure Investment and Jobs Human action expires; Export-Import Banking company authorization expires

- 2027: Highway Trust Fund insolvency

- 2033: Social Security Old-Age and Survivors Insurance (OASI) Trust Fund exhaustion (combined OASI and SSDI exhaustion date is 2034)

- 2057: Social Security Disability Insurance (SSDI) Trust Fund exhaustion

The Highway Trust Fund burnout dates are estimates provided by the Committee for a Responsible Federal Budget; a new Congressional Budget Office Approximate following enactment of the bipartisan infrastructure police force is expected in the coming months. The Social Security and Medicare dates are estimates provided by their respective trustees.

Expired deadlines include the foreclosure moratorium (on July 31 for the general moratorium and on September 30 for starting new forbearance plans), the eviction moratorium (on Baronial 26 following a Supreme Court opinion that effectively ended even a more limited version of the policy), increased unemployment compensation benefits (on September 6), the Pandemic Unemployment Assistance and Pandemic Emergency Unemployment Compensation programs (on September half dozen), COVID-related paid sick leave reimbursed via payroll tax credits (on September 30), the employee memory credit that provided a refundable payroll tax credit for up to $ten,000 of wages per employee (on September 30), use of money from the Coronavirus Relief Fund for States & Localities (on Dec 31), the COVID-related payroll tax deferral (on December 31), the enhanced child tax credit from the American Rescue Plan (on December 31), the enhanced child and dependent care tax credit (on Dec 31), certain COVID-related revenue enhancement policies pertaining to charitable deductions and health savings accounts (on Dec 31), dozens of tax extenders for individuals and businesses that are routinely renewed (on Dec 31), and certain taxation policies under the 2017 tax law (TCJA) that touch how businesses tin can deduct interest and research & experimentation costs (on December 31), and COVID-related Emergency Injury Disaster Loan grants (on December 31).

Tags

Source: https://www.crfb.org/blogs/upcoming-congressional-fiscal-policy-deadlines

Post a Comment for "When Does the Federal Budget Run Out Again"